- Bulls charge their way up, while Bears grind their way down. The bull market rallies are generally sharp & steep, while bear market corrections generally are slow.

- The turn of bull market to a bear market is very slow. The turn from bear market to bull market is sudden & happens when the last bull gives up hope!

- In Bear markets when investors get frustrated because the market gives them hope of recovery & corrects again. Bull markets hardly give a chance of entry as market rallies without a pause.

- Because bull markets begin at the point of utmost pessimism & because the rallies are very sharp many investors tend to miss good part of the rally. Remember Mar 2009, Dec 2011 & Aug 2013?

- Bulls are known for stampeding in thundering herds, bears don’t run in herds. They hunt in small groups & don’t make much noise. In Bull market everything rallies & everybody makes money. Bear Markets segregate wheat from chaff. In bear market corrections happen one sector, one stock at a time & not everything corrects at the same time.

Each stock, each sector, each commodity, every mutual fund & every asset class including real estate pass through bear & bull phase. Some have smaller cycle & some longer cycles. But this applies to everyone.

Here are some quotes from renown investors about bulls market & bear market:

- The boom & bust were normal – just two more swings in the stock returns over the past century. Reversion to mean is the iron rule of financial markets. –John Bogle.

- In life & business, there are 2 Cardinal sins. First is to act precipitously without a thought & second is not to act at all. – Carl Icahn.

- The four most expensive words in the English language are, This time it is different. –John Templeton

- With every new wave of optimism or pessimism, we are ready to abandon history and time tested principles. But we cling tenaciously and unquestioningly to our prejudices- Benjanmin Graham.

- Stock market is a story of cycles and of human behaviour that is responsible for over-reaction in both the directions. – Seth Klarman

- If past was all that was there to the game, the richest people would have been librarians. – Warren Buffet

- Even the intelligent investors are likely to need considerable will power to keep from following the crowd.- Benjamin Graham

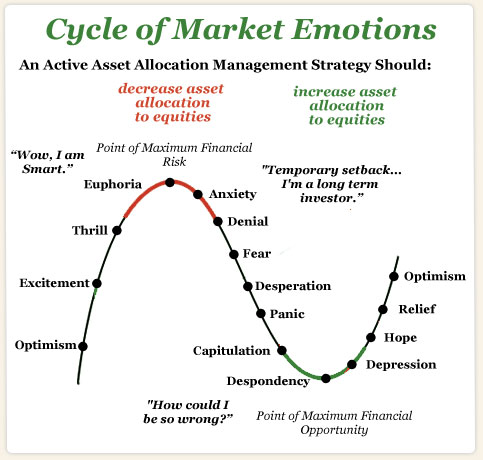

Market Emotions in a full market cycle: